Longer life expectancy means less financial stability in the latter years

By Elliot Chan, Opinions Editor

For those still in their roaring 20s, let’s think longterm for a moment—say, 40 years from now. The world has changed and so have you. You have a family, a mortgage, car payments, a stable job, ailing parents, credit card debt, medical bills, and multiple other financial responsibilities to worry about, yet retirement is around the corner. You ask yourself, “Am I ready for it? Have I saved enough? Or will the next 20 years be as gruelling as the first?”

Don’t act so surprised when I tell you that most millennials aren’t thinking about retirement—not because they don’t want to, but because they might not get one. We have been crippled by so many different factors, including increased taxes and cost of living, disappearing pensions, high educational debt, and a competitive job market. At this point, it’s hard to imagine life as a 40-year-old, let alone a 70-year-old.

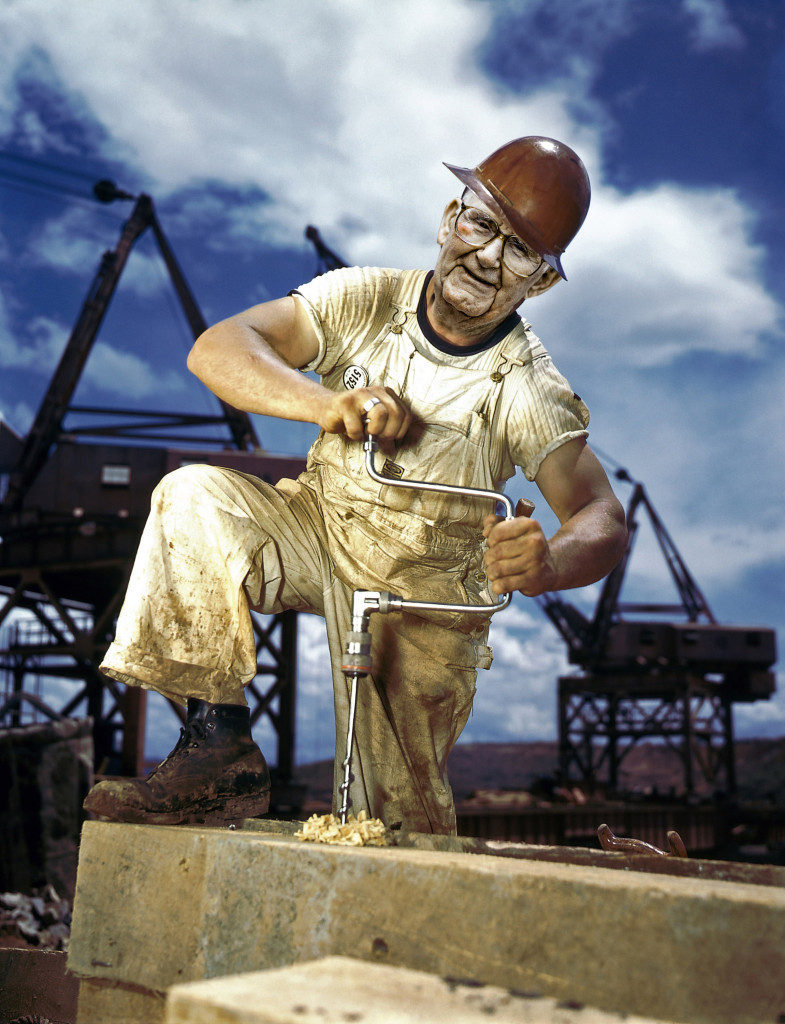

It’s rare to see people hang up their work clothes at 55 nowadays. According to Statistics Canada, the average retirement age in 2011 was 63.2 for men and 61.4 for women. There are simply too many financial burdens, so every extra year of work adds a buffer to the savings account. If baby boomers are having such difficulty retiring, what about the millennials?

I’m not saying that we should call for a crisis or have the government hold our hands through this lifelong ordeal, but what would benefit us is a bit of systematic assistance. I suggest a mandatory test every decade to help with the retirement mathematics. The test would examine multiple factors, including financial stability, health, and family status. Although privacy is important, it’s critical that we learn to take care of ourselves, lest we become burdens on our family, friends, and society. This will break our fears and reluctance of taking out the “retirement calculators” and finding out how many dreadful zeros we’ll need in order to survive.

Retirement funds aren’t a problem we millennials can solve now. What we can do is stay the course, and even if there aren’t any implemented tests to assess our stability, we can still manage that ourselves. Don’t waste your youth worrying, but it never hurts to consider the necessities of your long life. A survey done by Pentegra Retirement Services found that 62 per cent of 18 to 34-year-olds think $500,000 is enough for their retirement. The consensus is that number is too low. According to Statistics Canada, the current annual spending cost of a couple over 65 is $51,000, but for an enjoyable retirement they’ll need as much as $60,000 a year. The price will undoubtedly increase for us.

It might seem completely bleak at the moment, but allow us to go back to the short-term; we’re still young and we have full control of our lives. We’re packed with potential and opportunities are still knocking. If we don’t want to be eating peanut butter and jelly everyday in our old age, we can change that. Now is the time to get the upper hand. Rainy days and debts are inevitable, but hey, there’s a silver lining to those looming golden years.